In this part three of using technical indicators, we will be talking about bollinger bands, MACD, and fibonacci replacements. So sit back and relax while you learn.

1. Bollinger bands

The use of bollinger bands are to determine extreme highs or lows with relationship to price. They come about with volatility curves. The use of bollinger bands are more complex han many others. It involves the establishment of parameters for trading, depending on the moving average of a specific instrument.

You might need the help of an experienced fores trader to help you dive through this technical indicator, because it can not be explained without many different diagrams.

2. MACD (Moving Average Convergence Divergence)

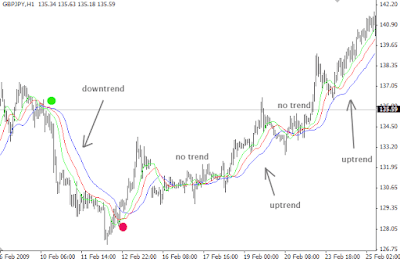

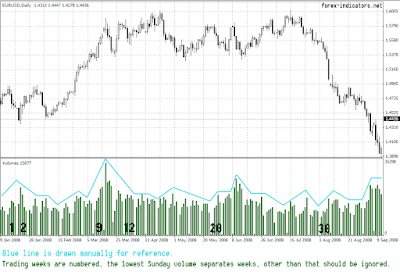

This indicator is more detailed moving average used to search out trading signals with the use of price charts. The MACD developed by Gerald Appel plots the difference between a 26-day exponential moving average and a 12-day exponential moving average. At most time, a 9-day moving average is used as a line for trigger. This means that when the MACD line crosses lower than the trigger, it means there is a bearish signal. And vice versa, for the bullish signal.

What many forex traders do is to allow MACD provide them with an early divergent signal so that they can have an idea of when to get into the market.

In the case where the MACD is positive, and there are higher lows, it could mean a signal for buying a position. And if your MACD shows lower highs, this can also mean a signal for selling a position.

3. Fibonacci retracements

This type of indicators are a series of numbers that was discovered by Leonardo da Pisa who is a mathematician during the 12th century.

The fibonacci retracement is very useful in analysing pullbacks in forex trading today. It involves the anticipation of trand changes not far from the created lines. After a real and good price move in either direction, there is usually a price retracement along the original move in either direction. As these retracements go on, there are usually occurrence of supports and resistance levels at or close near the Fibonacci retracement levels.