Knowing which technical indicator to use in the identifying of trends is vitally important as much as making profits from the forex market.

Trust me, the trend can go agaoinst you if you don't have a good strategy, if you can't identify it, and if you don't know which technical indicator to use. You can be sure the trend will be your enemy at this time.

For the purpose of study, we will discuss on which technical indicator you can use to identify trends.

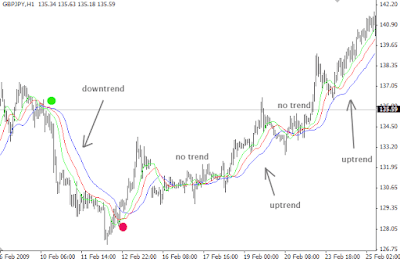

You should also be aware that trend do not occur as usual as sideways movement. Sideways occurs all the time, but when trends show up, it is an opportunity for you to tap into it and enjoy the ride to profits making.

As an example, currency market have shown to have more long-term trends than many other markets. These long-term trends as we know from previous discussions are caused as a result of macroeconomic elements.

In the history of the forex market, the analysis have shown that the periods that trend occurs are only 1/3, while that of no trend accounts for 2/3 of the market price over a period of time.

Making the situation more difficult is by using one or two technical indicators to identify the direction of the market, and then open a position based on this analysis. This type of approach opens traders to the trend/no-trend paradox. So you will usually find many forex traders closing a position and then realizing that the main and real trend is just unfolding and starting to move. Apparently, they miss out the action.

Again, there are traders who hold on to an open position, thinking a trend will come out of it, whereas there is no trend at all.

In other not to be caught in this trend/no-trend paradox, there are several indicators and techniques that will be shown to you to help you determine when trends are coming into existence.

The essence of this information is to give you an indication of your real entry point, and your real exit point. Also you get opportunities to know what risk management strategies will work for you. You apparently do not need to set up a lot of techniques, but you can get just a few techniques and turn profits into your accounts daily.